Tax bills on the way

Pictured are the 2016 Monroe County property tax bills being printed at MAR Graphics in Valmeyer. Tax bills are expected to be mailed out later this week. (Alan Dooley photo)

While the late date might have had some Monroe County residents wondering if they were getting a reprieve this year from their property taxes, Monroe County Treasurer Kevin Koenigstein announced the bills are expected to be mailed out later this week. The treasurer’s office is set to collect $54.3 million in property taxes this year, up slightly from $51.56 million last year.

These taxes support the local schools, road districts and municipalities, as well as the county itself.

The county’s portion of this year’s tax bill is up slightly − $6.87 million compared to $6.52 million last year. The county’s current tax rate is .88529 percent, which is up from last year’s rate of .86320 percent.

“Once again, the county is seeing a slight increase in real estate taxes in most of the communities across the county,” Koenigstein said. “The county portion is also up, after three consecutive years of decreases.”

First payments are due by Tuesday, Oct. 18, with the second installment due by Friday, Nov. 18. Bills can be paid at local banks, at the treasurer’s office in the courthouse, or by mail. For more information, call 939-8681, ext. 213.

“We encourage everyone to pay early if they can,” Koenigstein said.

The overall tax rate in Waterloo is down, while the rates in Columbia, Valmeyer, Hecker, Maeystown and Fults are up very slightly from one year ago.

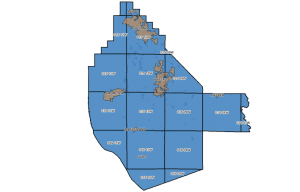

For a breakdown of tax rates in Monroe County municipalities, see the chart below.

*****************

Comparative tax rates for Monroe County municipalities for tax levy year 2015, payable in 2016.

Waterloo taxing districts

Monroe County: 0.88529

School District: 4.29944

SWIC: 0.46629

City of Waterloo: 0.53783

Park District: 0.12820

Cemetery District: 0.00439

Fire District: 0.31365

Total rate: 6.63509

(Real estate tax on a $150,000 home assessed at $50,000 = $3,317.56)

Columbia taxing districts

Monroe County: 0.88529

School District: 4.65295

SWIC: 0.46629

City of Columbia: 0.93397

Fire District: 0.25265

Total rate: 7.19115

(Real estate tax on a $150,000 home assessed at $50,000 = $3,595.58)

Valmeyer taxing districts

Monroe County: 0.88529

School District: 4.56272

SWIC: 0.46629

Vill. of Valmeyer: 0.93617

Fire District: 0.29744

Library District: 0.11977

Total rate: 7.26768

(Real estate tax on a $150,000 home assessed at $50,000 = $3,633.84)

Hecker taxing districts

Monroe County: 0.88529

Waterloo Schools: 4.29944

SWIC: 0.46629

Vill. of Hecker: 0.65222

Fire District: 0.33388

Total rate: 6.63712

(Real estate tax on a $150,000 home assessed at $50,000 = $3,318.56)

Maeystown taxing districts

Monroe County: 0.88529

Valmeyer Schools: 4.56272

SWIC: 0.46629

Vill. of Maeys.: 0.52305

Fire District: 0.43980

Val. Library Dist.: 0.11977

Total rate: 6.99692

(Real estate tax on a $150,000 home assessed at $50,000 = 3,498.46)

Fults taxing districts

Monroe County: 0.88529

Valmeyer Schools: 4.56272

SWIC: 0.46629

Vill. of Fults: 0.44500

Fire District: 0.43980

Road District: 0.60913

Val. Library Dist.: 0.11977

Total rate: 7.97247

(Real estate tax on a $150,000 home assessed at $50,000 = $3,986.24)