County approves budget

Monroe County Treasurer Kevin Koenigstein wished all in attendance of Monday’ meeting of the Monroe County Board a “Happy Fiscal New Year.”

After months of discussions, the county budget for Fiscal Year 2025, beginning Dec. 1, 2024, was passed.

Koenigstein had more to celebrate than simply completion of the budget, as he reported Monroe County’s share of property taxes collected in 2025 will be slightly lower than the total for 2024.

With assessed valuation of property in Monroe County continuing to rise, for some taxing bodies, the rate of taxation – not the total tax amount collected – has dropped despite the total tax levy increasing.

In this instance, Monroe County’s rate and total will be lower in FY25.

To cover Monroe County’s operating expenses, the request is $8,604,836 from the next tax payments in 2025 compared to the $8,613,349 the county will collect once the current tax cycle concludes early next year.

Koenigstein was optimistic about the county’s financial shape heading into the latest financial cycle.

During a special meeting of the county board Nov. 25 to wrap up final business in FY24, Commissioner Vicki Koerber reported she was questioned by a taxpayer as to why her overall tax bill went up even though the county’s tax levy has not significantly increased recently and will be lower in FY25.

Koerber explained the county is only one portion of the overall bill, and tax payments may increase if a separate taxing entity raises its levy or if a home’s assessed valuation increases.

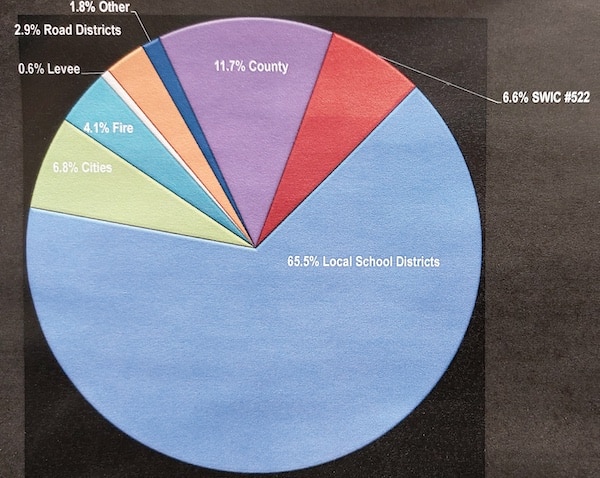

Of the more than $73 million Monroe County will collect this year for 2023 property taxes, only $8.61 million – 11.7 percent – goes to the county to finance its various departments.

The largest portion of all taxes collected in Monroe County – 65.5 percent this year – are disbursed to local school districts.

There were no major decreases in county department operating budgets to account for lower taxes, but there is a line item which is $400,000 lower than it has been the previous 20 years.

Koenigstein reiterated the final payment on a bond issued in 2005 for construction of the Oak Hill senior living and rehabilitation in Waterloo will be paid in March.

For the past two decades, the county has made annual payments of $1 million to satisfy debt incurred during construction of Oak Hill.

The final payment of $250,000 allowed a reduction in the “nursing home bond” budget from $750,000 to $350,000.

Overall, Koenigstein predicted Monroe County would generate about $12 million in revenue during the upcoming fiscal year, adding he was “very confident” the county would end FY25 with a surplus despite a courthouse repair project expected to cost at least $700,000.

For several years, Koenigstein has repeatedly reported high revenue totals for sales and income tax receipts for the county, also noting the inflation driving the increases also causes a rise in expenses.

The final FY24 budget showed an $800,000 surplus. However, Koenigstein noted the final budget revenue numbers have been somewhat misleading in recent years given the potential for three property tax payment collections in the same year due to a continued trend of the second due date for property taxes occurring nearly one month into the new fiscal year.

The second due date for 2023 property taxes payable in 2024 is Dec. 27. Payments may be made in-person at the Monroe County Courthouse or online at monroecountyil.gov. There is also a drive-up drop box located near the east entrance to the courthouse.

In the latest county budget, individual department budgets were very similar to the prior fiscal year for the most part.

One exception involved the Monroe County Coroner’s Office budget. This department requested an additional $61,000 for the purchase of a new vehicle.

After a brief discussion of possible alternatives to buying a new vehicle, the board decided to allow the budget increase.

The “elections” budget showed a $58,000 expense increase over the previous year, although Koenigstein explained the bump is needed to cover the cost of an audit to be performed in the coming year to ensure county polling locations are compliant with the Americans with Disabilities Act.

Even though the Monroe County Sheriff’s Department went over budget in the past year by about $70,000, Koenigstein reported revenue from the federal inmate housing program vastly exceeded expectations, bringing in $608,709 in FY24 against a $400,000 projection.

The MCSD budget request of $4,210,745 was also lower for the upcoming year by almost $370,000 despite a request for more personnel funding. Koenigstein noted the budget for county dispatch services has been transferred to the Monroe County Emergency Management Agency.

The MCSD budget also included funding for more personnel.

The EMA budget request increased almost $700,000 from $295,002 to $992.853.

The commissioners themselves exceeded their own FY24 budgeted expenses due to additional costs associated with an unexpected change in auditing services.

The Monroe County Circuit Clerk’s Office budget request is up nearly $90,000 due to an expected increase in the need for full- and part-time deputy clerk wages.

A windfall created as a result of investing American Relief Plan Act funds is drying up in the new fiscal year.

Total interest from all investments totalled $847,140 in FY24, but the same line item is only slated to gain $550,000 in revenue for FY25.

Those numbers are up drastically from fiscal years in the previous decade.

The ARPA funds must be earmarked by the end of the 2024 calendar year and spent in 2025.

Commissioners will discuss how to spend the remaining ARPA funds of just over $100,000 during its Dec. 16 county board meeting.

Commissioners also made a last-minute change to the courthouse/jail budget in increasing the salary of Monroe County Maintenance Director Joe Lewis to make it the same level as the salary of the Oak Hill maintenance director, with Koerber pointing out Lewis is in charge of four buildings while the Oak Hill director is only responsible for one.

An updated version of the final budget is available at monroecountyil.gov/departments/treasurers-office.

Detailed tax distribution summaries from 2011 to present are also available at the above address.

Other topics were discussed during Monday’s meeting, chiefly the election of George Green to board chair and Koerber as vice chairman.

Monroe County Engineer Aaron Metzger also gave commissioners an overview of his department’s project plans for the next several years.

Read more on county board business in an upcoming issue of the Republic-Times.

The next meeting of the Monroe County Board is Dec. 16 at 8:15 a.m. in the Monroe County Courthouse.